November 21, 2024

SINGAPORE – Scammers show no sign of letting up here with claims from victims continuing to pile up.

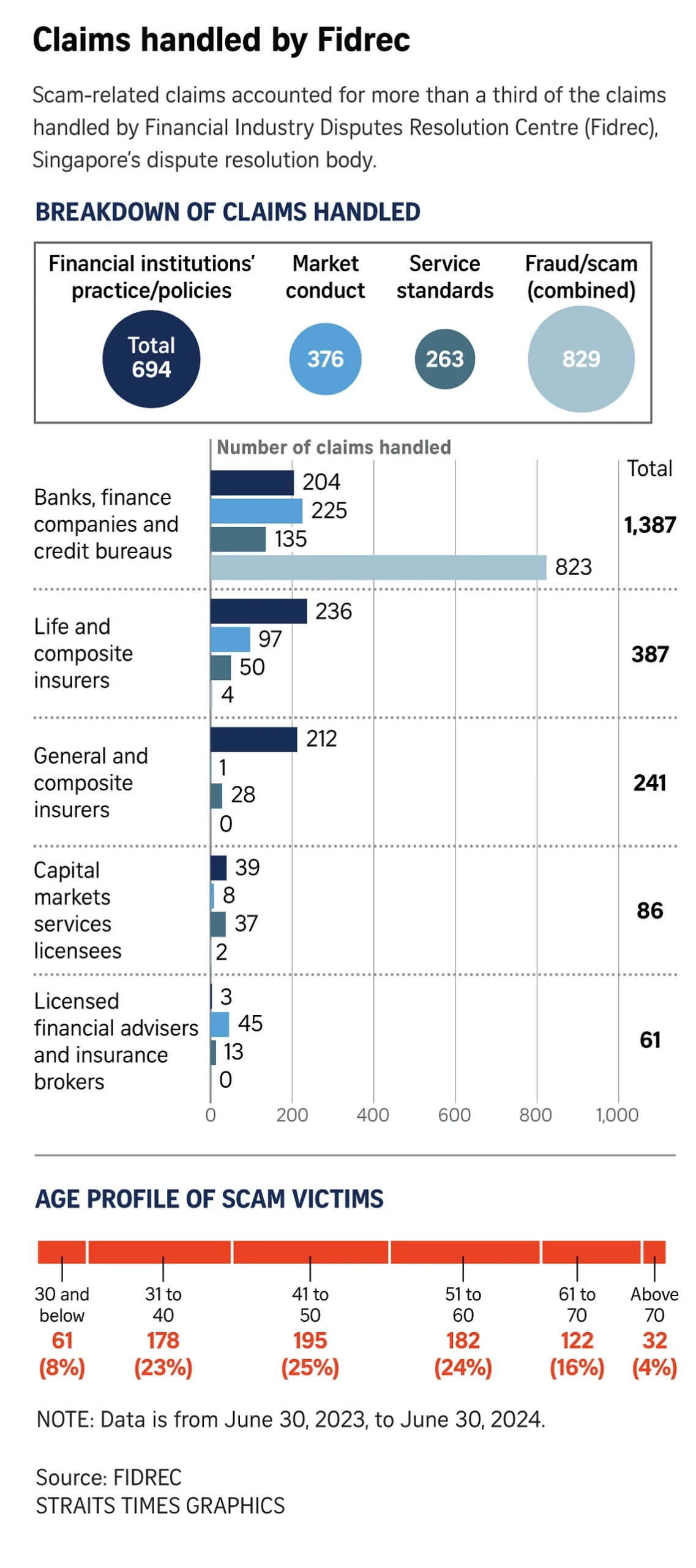

Frauds comprised the bulk – 38 per cent – of all claims handled by the Financial Industry Disputes Resolution Centre (Fidrec) in the 12 months to June 30, 2024, which is the dispute resolution body’s 2023 financial year.

The number of fraud claims shot up as well, with 829 in the year, a marked rise of 63 per cent from the 509 recorded in the previous 12 months, Fidrec noted on Nov 21.

The total number of claims handled rose from 1,495 to 2,162, an increase of 45 per cent from 2022, while the average amount claimed hit $51,599, up 12.8 per cent from $45,760.

Fidrec received 261 fraud claims in 2021, 509 in 2022 and 829 in 2023.

Scam-related claims as a proportion of total claims have also been rising. They comprised 28.8 per cent in 2021, 34 per cent in 2022 and 38 per cent in 2023. Notably, 59 per cent of the scams originated from credit card usage.

Many people think that older folk are more susceptible to scams, but Fidrec noted that those aged between 31 and 60 made up 72 per cent of the claimants, while those over 61 comprised 20 per cent.

Chief executive Eunice Chua said most scams happened because a victim’s credentials were compromised.

This usually meant a person’s bank account, digital wallet or credit card had certain transactions that they did not authorise.

Ms Chua added that such scams can be prevented if people keep a close eye on their transactions by checking bank accounts regularly while also using two-factor authentication and installing anti-virus and anti-malware programs on their devices.

The simplest way, she added, is to use ScamShield, which was developed by the Government to detect and block scam messages and calls.

Ms Chua noted that it is important for family and friends to look out for one another because sometimes victims do not even realise they have been scammed.

“Perhaps the person is under psychological pressure or has been tricked,” she said, adding that in such situations, “a family member or a friend has noticed and they help to break the psychological spell”.

Singapore introduced the Protection from Scams Bill on Nov 11, which aims to give the police powers to control the bank accounts of stubborn victims, who insist they are not being scammed.

The Bill proposes allowing the police to issue orders to banks, which will then restrict transactions on these individual accounts.

The second-biggest category of claims after scams relates to financial institutions. There were 694 such cases, up 49 per cent on the 465 in 2022.

Ms Chua said these claims generally centre on contractual disputes between the consumer and a financial institution, whether an insurer or a bank.

“For complaints against insurers, this is usually about claims that were rejected,” she noted, adding that “with banks, complaints are usually over fees or charges that the consumer said they are not aware of”.

Such claims are different from market conduct claims, which implies wrongdoing on the part of the financial adviser.

Banks and finance companies recorded the most claims –1,387 cases this year, an increase of 39 per cent from 998 in 2022.

CHART: STRAITS TIMES GRAPHICS

Life and composite insurers had 387 claims lodged against them, more than double the 191 in 2022.

Licensed financial advisers and insurance brokers had the least claims – 61 – made against them, but that still represented an increase of 61 per cent from the previous year.

Ms Chua said consumers have to do more to try and avoid or prevent disputes by being more aware and understand the products they are buying before they sign on the dotted line.

They should monitor their bank accounts regularly so they can identify suspicious transactions.

She noted: “When you have a claim, the first thing consumers should do is to complain directly to the financial institution.

“If they are not satisfied with the outcome, they can appeal to the financial institution. Try to see if they can resolve it directly first before they escalate it further.“