November 17, 2023

DHAKA – Renewable energy is going to be the cheapest option for Bangladesh to meet growing electricity demand in the long term, the Centre for Policy Dialogue (CPD) said, citing a Bloomberg report.

The independent think-tank said Bloomberg carried out an analysis of the cost of electricity generation from different sources in Bangladesh last month.

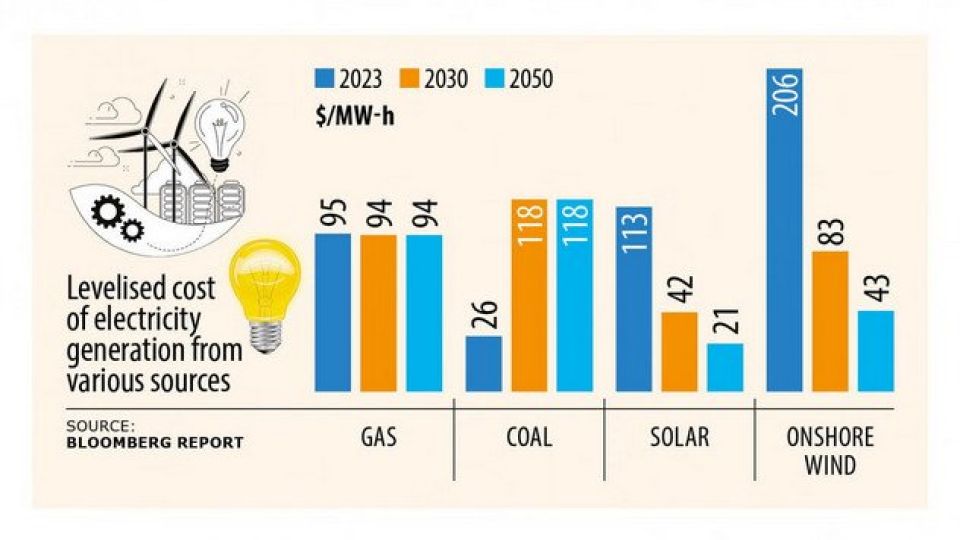

The report, titled “Bangladesh Power Sector at the Crossroads”, found that the Levelised Cost of Electricity (LCOE) from renewable sources is expected to significantly decrease by 2030 and 2050 if Bangladesh continues progressing at the current pace.

LCOE measures lifetime costs divided by energy production. It calculates the present value of the total cost of building and operating a power plant over its assumed lifetime.

“Renewable energy is the future for Bangladesh in the long term,” said CPD Research Director Khondaker Golam Moazzem at a briefing to mark the launch of a quarterly on Bangladesh’s power and energy sector, titled ‘Currents of Change’, at its office.

Citing the Bloomberg report, the CPD said the LCOE for a new utility-scale solar project in Bangladesh ranges from $97-135 per Mega Watt hour (MWh) today compared to $88-116 per MWh for a combined cycle gas turbine plant, and $110-150 per MWh for a coal power plant.

By 2025, solar will become the cheapest option thanks to continued technology cost reductions. By 2030, solar with batteries will also achieve a cheaper LCOE than thermal power plants, according to the Bloomberg report.

The CPD, citing the report, said building more thermal power plants in Bangladesh and incorporating co-firing ammonia or blending hydrogen by 2030 is unlikely to be cost effective for emission reduction compared to alternative renewable energy solutions like solar or wind.

“Imported hydrogen procurement could be four to five times more expensive than natural gas procurement. Ammonia procurement could be seven times more expensive than coal procurement,” it said.

The CPD said the new Integrated Energy and Power Master Plan (IEPMP) looks to introduce hydrogen and ammonia by 2030 to achieve the clean energy target.

“Such reliance on hydrogen as a fuel for electricity would significantly increase the financial burden on Bangladesh,” said CPD Research Associate Helen Mashiyat Preoty while presenting the CPD’s quarterly report.

Bloomberg’s findings come at a time when Bangladesh is aiming to generate 40 percent of its required energy through renewable sources by 2041.

The total installed renewable energy-based electricity generation capacity at present is only 1,195 MW, which is only 4.6 percent of the nation’s total installed electricity generation capacity.

The CPD also added that progress in the renewables sector fell short of expectations in 2023.

Up to July 2023, a total of 13 renewable energy power plants were scheduled to start commercial operation, providing a total generation capacity of 531 MW. None of them began commercial operations on time, Preoty said.

On the other hand, fossil-fuel-based power generation increased.

“Even during the last quarter, power generated from imported oil was being replaced by coal-based power generation due to the high import cost of fuel and the unavailability of gas, including LNG,” said the CPD.

It said there has been progress in transmission lines and substations, but power interruption and outage frequency increased during July and September of 2023.

Besides, the state continues to suffer from the burden of capacity payments to independent power producers and rental power plants.

In the last 12 years, the government has paid a total of Tk 104,000 crore as capacity payments to these power plants, according to the CPD.

At the same time, the foreign reserve crisis and higher dependence on imported fuel have increased challenges for Petrobangla and Bangladesh Petroleum Corporation (BPC).

The CPD said Petrobangla’s outstanding overdue payments to these Liquified Natural Gas (LNG) suppliers have accumulated to approximately US$300 million while BPC’s overdue payments to international suppliers increased to $670 million as of September 30 this year.

Moazzem said Bangladesh’s power and energy sector had been suffering from several problems, namely weak energy security, load-shedding, and a lack of financial capacity to import fuel to meet needs.

He said the government needed to focus on exploring gas and other sources of fuel locally.

“Instead, we see a tendency to import LNG to meet energy demand even by borrowing. This raises questions whether it (the lack of interest in exploring gas locally) is because of the pressure of the LNG import lobby,” he said.

Moazzem urged the government to go for buying electricity from private power producers on a ‘no electricity, no payment’ basis and to rid the state of the burden of capacity payments.

“Capacity charges are a huge waste. At this moment, the economy does not have the capacity to bear the burden,” he said, adding that the problem in the power and energy supply is likely to persist in the coming months because of the increased cost of US dollars and import dependence for fuel.