November 28, 2023

MANILA – Social media influencers have been ignoring notices from the Bureau of Internal Revenue (BIR) for them to voluntarily comply with tax laws, prompting the agency to consider filing tax evasion cases against them.

The BIR earlier said it was relying on the influencers’ voluntary compliance as taxing them “might take some time” because the income they get generally comes from technology giants based abroad where the BIR has no jurisdiction.

“As we look at compliance and returns of requests for information, issuance of LOA (letters of authority) and/or filing of cases for tax evasion [because of their] disregard of BIR notices is not unlikely,” BIR Assistant Commissioner Jethro Sabariaga said in a Viber message when sought for comment.

Sabariaga did not provide data on how many influencers were still being monitored by the BIR, saying the operation was a “nationwide-deployed activity.”

The BIR started its crackdown on tax-delinquent influencers in 2021, targeting about 250 social media celebrities estimated to have earned millions of pesos and raked in freebies through their vlogs and social media posts.

Need for revenues

The move followed the urgent need of the cash-strapped government to cash in on the exponential growth of the digital space during a pandemic that strained the state’s balance sheet.

The BIR said back then that it had issued LOAs to the unnamed influencers who, based on initial BIR investigation, belonged to the “top earners.”

LOAs are an official BIR document that empowers revenue officers to examine and scrutinize taxpayers’ books to determine their correct tax liabilities.

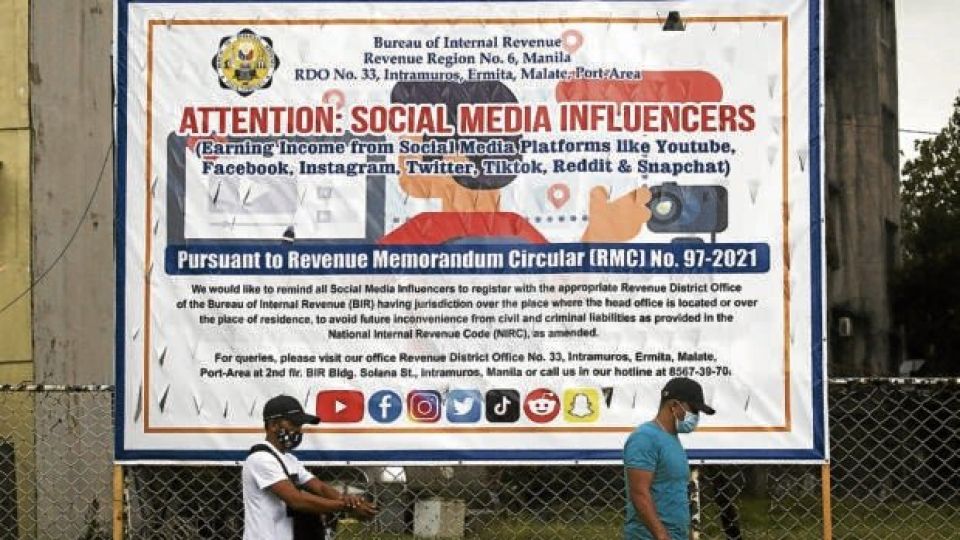

Under Revenue Memorandum Circular (RMC) No. 97-2021, influencers must pay income and business taxes — either a percentage tax or a value-added tax (VAT) — since they were considered self-employed individuals.

However, the BIR immediately faced a hurdle after some big influencers deactivated their social media accounts for various reasons right after the RMC 97-2021 issuance.

The BIR said then that the bureau’s information systems group might still trace these influencers’ digital footprint.

The program, however, was not a total failure, as more than 100 social media influencers registered and committed to settling their dues.

Finance Assistant Secretary Dakila Napao said that as of September 2021, 105 influencers and content creators had registered as taxpayers at the BIR.

Big earners

Industry estimates showed that an influencer with a million followers could earn P100,000 to P150,000 for a single Instagram post.

Those with less than a million followers get paid between P50,000 and P80,000, while content creators whose follower count falls below six digits command a rate between P25,000 and P40,000.

Eleanor Roque, tax advisory head at accounting and auditing firm P&A Grant Thornton, said earlier that the BIR could rely only on voluntary compliance for now as the income of social media influencers generally came from big tech companies based abroad.

“So if the influencer does not voluntarily comply, the BIR needs to get information from foreign tax jurisdictions or foreign corporations to give them the needed information,” Roque said.

She added that the BIR could also send letters to social media personalities requiring them to register with the bureau and comply with tax rules.

Favored marketer

The increase in internet penetration fueled the rapid growth of social media, which has become a big influence on consumer spending.

Many social media users now use online platforms to research and eventually buy products and services.

This has, in turn, led more companies to shift from traditional advertising toward social media, relying on—and paying—influencers to promote their products and services.

Influencers thus become a vital component of marketing, making social media influencers earn substantial amounts from regular posts on popular social media apps such as Facebook, Instagram, YouTube and TikTok.

When the BIR noticed that many of the local social media influencers were not registered or paying taxes, it reminded these influencers of their obligations under existing tax laws and the possible sanctions for their failure to pay taxes.

The BIR defines social media influencers as those who derive income from the YouTube Partner Program, sponsored social and blog posts, display advertising, and payment as brand representatives or ambassadors.

Crackdown

These influencers can also earn through affiliate marketing, co-creating product lines and promoting their own products; photo and video sales; digital courses, subscriptions, and e-books, as well as podcasts and webinars.

The BIR said the taxable income of influencers would include payments received in consideration for services, regardless of the manner or form of payment.

For instance, if an influencer receives free products in exchange for promotion, they must declare the fair value of such products as income.

The same is true for income treated as royalties originating from another country, such as payments from YouTube and this must be included in the computation of the gross income.