February 1, 2024

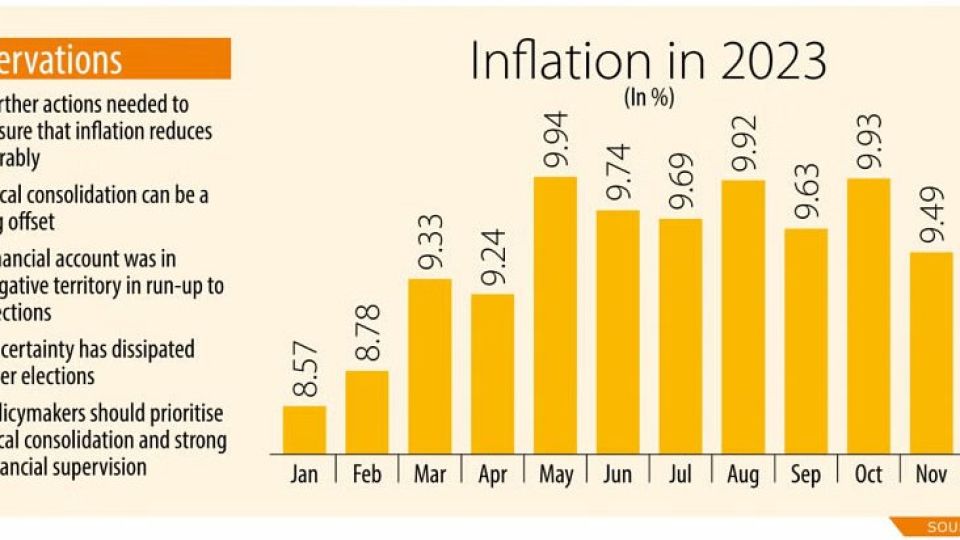

DHAKA – The International Monetary Fund (IMF) said that the latest monetary policy adopted by the Bangladesh Bank would help to curb inflation, but added that further measures would be needed to make it durable.

“They have taken measures to tighten the monetary policy to bring inflation down. And inflation is coming down, but further actions are needed to ensure that inflation durably comes down and comes back to target sooner rather than later,” Krishna Srinivasan, director of the IMF’s Asia and Pacific department, said during a press briefing in Tokyo.

Selected journalists from Bangladesh virtually participated in the programme, titled ‘Regional Economic Outlook Update for Asia and the Pacific’.

The Bangladesh Bank on January 17 announced the latest monetary policy in line with the $4.7 billion IMF loan programme.

The new policy included an array of measures to bolster the fight against inflation, including hiking the policy rate by 25 basis points to 8 percent, and cutting the private sector credit growth target from 11 percent to 10 percent. The central bank also adopted a crawling peg to curb the exchange rate volatility.

These measures are aimed at bringing inflation down to 7.5 percent by the end of the current fiscal year.

When queried about the latest monetary policy, Srinivasan said: “In the context of back-to-back shocks, like many countries, Bangladesh too had to endure shocks, starting from COVID, to Russia’s war in Ukraine and subsequent shocks.

“In that context, Bangladesh sought access to an IMF-supported programme. And as part of the programme, there are many pillars. One pillar, of course, is to bring down inflation. The other is to ensure you have fiscal sustainability while protecting the poor and the vulnerable. You also had governance reforms,” he added.

Asked about the special bonds issued by the government to banks to repay outstanding dues to fertliser importers and independent power producers, he said: “There, it would be important to see what choices you have. The government, as part of the IMF-supported program, is embarking on significant fiscal tightening to ensure that revenue mobilisation remains robust, expenditures are more targeted, and so on.”

“So, fiscal consolidation in that context can be a big offset. But the question is: how much more consolidation can it do? Again, this is something which the country team working in Bangladesh will be assessing, in the months forward to provide a more definitive answer.”

When asked if the Bangladesh’s IMF programme was on track, Srinivasan replied: “Broadly speaking, yes. We had a review on Bangladesh’s programme two months ago and it was satisfactory in terms of meeting the various conditionalities.

“There were some areas where they slipped, particularly on the external side, and that’s partly because the financial account was in the negative territory in the run-up to the election while current account was doing reasonably well because of surging exports and import compression.

“Now the election is behind, the uncertainty has dissipated we expect the financial account will get back into more resilient.”

On Asia’s overall economic outlook, he said: “Turning to Asia, the good news is that we have revised growth upward for both 2023 and 2024. The news has been mostly positive, which improves the prospects for a soft landing. We estimate that average Asian inflation fell from 3.8 percent in 2022 to 2.6 percent in 2023, with particularly swift progress in emerging Asian economies.”

However, even though the outlook has improved, important risks remain. For example, financial conditions are still volatile. “Tighter-than-expected conditions in the United States or Asia could put pressure on heavily indebted industries and economies.”

Asked what policymakers should prioritise, he said fiscal consolidation was key alongside strong financial supervision and systemic risk monitoring.