January 12, 2024

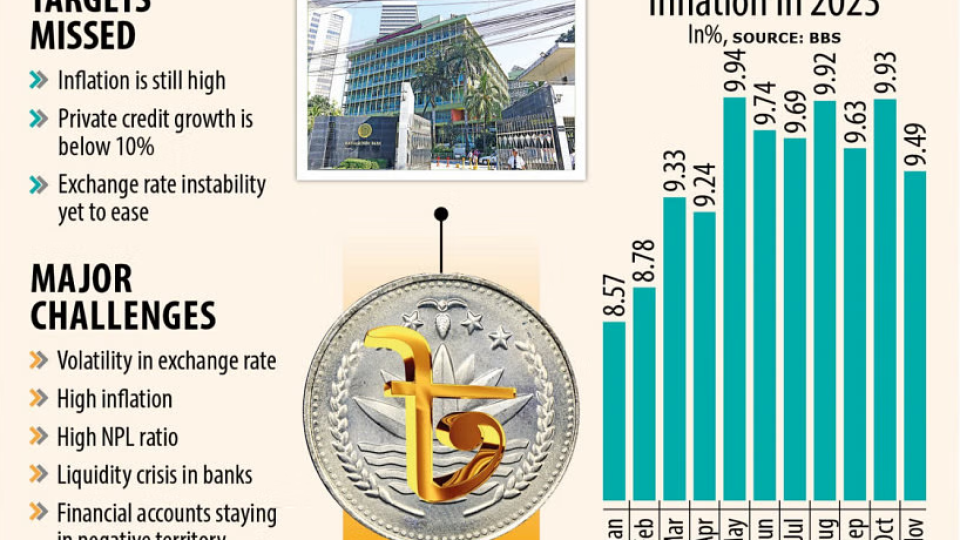

DHAKA – When Abdur Rouf Talukder unveiled his first monetary policy statement as the governor of the central bank in January last year, inflation was already above 8.5 percent. Since then, he presented one more statement and raised the benchmark lending rate eight times.

However, the Consumer Price Index (CPI) has not come under control. Rather, it shows no sign of slowing down.

Amid the raging inflation, the former finance secretary is going to present the MPS for the January-June period next week and it comes at a time when most of the targets fixed in the previous policy have remained unmet.

The banking regulator took opinions from economists, stakeholders, business leaders and journalists in the last two months to formulate the new policy amid the ongoing economic crisis.

BB’s monetary policy committee, which was restructured recently, will hold its final meeting tomorrow to draw up the MPS. The draft is likely to be presented to the central bank board on January 14 before making it public on January 15.

The new MPS is going to face tougher challenges when it comes to taming inflationary pressures, despite the BB hiking the policy rate by more than 400 basis points in two years and scrapping the lending rate cap.

Inflation stood at 9.49 percent in November, way above the government target of 6 percent for 2023-24, which ends in June. It stood at more than 9 percent since March.

Two other key challenges for the governor are the sharp drop in the foreign exchange reserves and the taka’s value against the US dollar.

On Monday, the reserves stood at $20.38 billion after the Asian Clearing Union payments, which was $40.7 billion in August 2021.

Amid the drying up of reserves, the local currency has weakened by more than 27 percent in the past two years.

Sadiq Ahmed, vice-chairman of the Policy Research Institute of Bangladesh, said the BB has recently taken three bold monetary policy actions to fight inflation.

It eliminated the controversial “6/9” interest rate policy, adopted a flexible interest rates policy and avoid the use of BB resources to finance the budget deficit, he said.

“The main focus of the MPS should be to facilitate the sound implementation of these major changes. The interest rate should be allowed to go up until the desired inflation rate of 5-6 percent is achieved.”

In June when the BB unveiled the last MPS, it was largely in line with the recommendations of the International Monetary Fund’s $4.7 billion loan programme.

The 9 percent lending rate ceiling was removed after three years and the banking regulator introduced a new rate-setting system, known as the Six-months Moving Average Rate of Treasury bill (SMART).

The central bank has allowed banks to add a maximum of 3.75 percent interest margin to the benchmark rate while lending.

The BB also had hiked the policy rate, or the repo rate, to 6.50 percent from 6 percent in the MPS. It was later increased twice to 7.75 percent.

The central bank promised to introduce a market-based exchange rate by September last year. But it is yet to be implemented although the volatility continues.

Now the Bangladesh Foreign Exchange Dealers Association (BAFEDA) and the Association and Bankers Bangladesh (ABB) are fixing the dollar rate. The mechanism is not working, said experts.

The MPS projected a 10.90 percent private sector credit growth as of December last year. In November, the growth stood at 9.9 percent, central bank data showed.

The banking regulator has identified three challenges – the exchange rate instability, high inflation and higher bad loans – that will be addressed in the new MPS, said central bank officials.

Zahid Hussain, a former lead economist of the World Bank, told The Daily Star that high inflation and the US dollar crisis are two major challenges facing the economy now.

The economist said the central bank has introduced the SMART. “The new MPS will have to explain the outcomes of the SMART so far and how will it be operated in the upcoming days.”

“The new MPS will have to explain why the BB did not announce the market-based exchange rate within the deadline.”

According to Hussain, there is a scope to increase the interest rate margin under the SMART to raise the lending rate further.

“The supply of the US dollar will have to be increased to tackle inflation since hiking the lending rate will not be able to bring it down alone.”

Fahmida Khatun, executive director at the Centre for Policy Dialogue, thinks higher inflation, exchange rate volatility and lack of governance in the banking sector will have to be addressed in the monetary policy.

“If needed the banking regulator will have to hike the policy rate further. The fiscal policy and the market management will also have to be corrective.”

Fahmida says the central bank should leave the exchange rate at the hands of the market, saying the difference between formal and informal markets will narrow if the market decides it.

“Then the supply of US dollars will increase.”