June 26, 2024

DHAKA – Bangladesh will have to comply with 33 new conditions by June next year in order to receive the next two instalments under the International Monetary Fund’s $4.7 billion loan programme.

It came as the lender approved the third tranche of $1.15 billion yesterday in a boost to Bangladesh’s foreign exchange reserves.

The fresh conditions are aimed at helping Bangladesh overcome four persisting challenges: depleting foreign currency reserves, rising inflation rate, lower revenue earnings, and a lack of governance in the banking sector.

In a letter to IMF’s Managing Director Kristalina Georgieva, Finance Minister Abul Hassan Mahmood Ali said: “Bangladesh continues to face challenges as external shocks persist, which has made it difficult to restore macroeconomic stability.”

“Considering persistently difficult external conditions, we commit to step up our efforts.”

He elaborated on the steps, saying it will raise revenues to enable higher development and social spending, enhance fiscal governance, modernise the monetary policy framework, and increase exchange rate flexibility further.

He also said that his government would work to reduce financial sector vulnerabilities and develop capital markets, improve the investment climate and boost productivity, and establish an enabling environment to better adapt to climate change.

IMF’s loan programme contains two types of conditions: seven are linked to performance criteria and the rest are related to structural benchmarks.

Of the seven, the country will have to increase its net international reserve (NIR) to $19.47 billion by next June. The revised target was $14.78 billion for June this year.

The primary budget deficit will have to be brought down to Tk 128,300 crore from the Tk 138,360 crore set for 2023-24, which ends on June 30. So, the government will have to tighten its belts in 2024-25.

The primary deficit is the difference between government revenues and expenses, excluding interest payments.

The government will have to raise its tax revenue to Tk 478,050 crore where the collection goal was Tk 394,530 crore for FY24. This means the country will have to mobilise more than 21 percent higher revenue, which could prove to be difficult since receipts averaged 15 percent in recent years.

The other three performance criteria are controlling reserve money, expanding social spending, raising capital investment of the government, and getting rid of external payment arrears.

Among the structural benchmarks, Bangladesh needs to fulfil five conditions this month and most of them are related to revenue collections.

As part of the condition, the country will prepare a report on tax exemptions given in the areas of personal income tax, corporate income tax, and value-added tax.

By September, the Bangladesh Bank will have to complete the first phase of the modernisation of its monetary policy framework in line with recommendations of the IMF in order to contain inflation.

“To address elevated inflation and falling foreign exchange reserves, we have realigned the exchange rate to the market-clearing level and simultaneously adopted a crawling peg with a band system as a transitional step toward greater exchange rate flexibility in line with the IMF recommendations,” said the finance minister.

The government has also initiated measures to further safeguard the foreign exchange reserves buffer with IMF assistance, he said.

“We have also adopted a mechanism of readjusting the band to allow for additional exchange rate flexibility and to prevent excessive loss of FX reserves.”

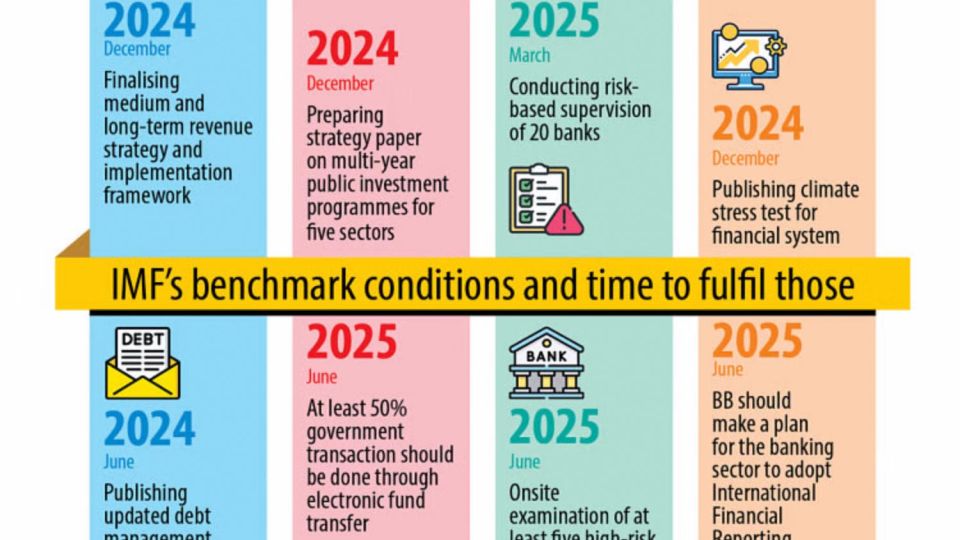

The country will have to fulfil five conditions by December. The National Board of Revenue (NBR) will have to adopt a tax compliance improvement plan covering VAT. It will finalise a medium and long-term revenue strategy covering indirect and direct taxes.

The planning ministry will formulate sector strategy papers and a multi-year public investment programme for five sectors.

The government will simplify organogram related to the supervision of each bank by a single team. It will issue an updated regulation to align the definition of non-performing exposures and forbearance in line with the Basel guidelines.

By June 2025, at least 50 percent of government transactions, excluding interest payments, subsidies, loans, equity, and liabilities will have to be carried out via electronic funds transfer.

The finance ministry will have to publish a report on state-owned enterprises (SOEs). This will also cover a detailed analysis of the financial health of at least 40 SOEs.

“In addition, we are committed to further tightening the monetary policy stance and recalibrating fiscal policy to support monetary tightening,” the minister added.

In a press release, Deputy Managing Director Antoinette M Sayeh said near-term policies of the country should focus on rebuilding external resilience and bringing down inflation.

“The authorities’ recent actions to realign the exchange rate and implement the new exchange rate arrangement are welcome.”

“Periodic reviews of the crawling peg would be important to ensure its effectiveness. Continued monetary and fiscal policy tightening would help to rein in inflation.”