February 10, 2023

MANILA – A farmer with seven children, Armando Danao said it’s tougher nowadays to make ends meet as prices of basic commodities keep rising so fast.

Living on P150 a day with his wife and children, he told INQUIRER.net that most often, they do not have enough money to meet basic needs, like food.

A farmer, Danao said he is not receiving wage on a daily basis. Instead, he relies on bale, or advanced payment, for his work to have something to bring home.

But since his income is so meager that it can’t even provide most of their needs, his wife and children, most of them below 10 years old, are extending a helping hand by selling broomsticks.

While they are surviving, Danao said having limited money to spend meant sacrificing some commodities, even if these are really needed.

Take as an example his children wearing “giveaway” shirts from last year’s elections, which are clearly too large for them, instead of having ones that are more comfortable for them.

“Ibibili na lang muna namin ng pagkain kasi mas mahirap kung magutom kami (We’ll use our money for food in the meantime since it is tougher if all of us will starve),” he said.

It’s easy to see Danao and his family’s condition as a result of lack of more stable work, but his case is not unique.

As the think tank Ibon Foundation said, even the employed, especially given the minimal wage they are receiving, are finding it hard to cope with high inflation.

Last Tuesday (Feb. 7), the Philippine Statistics Authority (PSA) said inflation, which is the rate of increase in prices over a given period of time, hit a new 14-year high of 8.7 percent last month.

READ: Philippine inflation rose to 8.7% in January

The highest since November 2008, the latest readout is higher than 8.1 percent in December 2022 and 3 percent in January 2022.

“Tens of millions of Filipinos entered the new year poorly positioned to cope with even higher prices and inflation,”Ibon Foundation said.

This, as based on the think tank’s estimates, employment in informal work increased from 29.3 million in 2019 to 32.8 million in 2022.

Inflation hitting most essential needs

The fast acceleration in the price index of housing, water, electricity, gas and other fuels, which increased to 8.5 percent from 7 percent, mainly contributed to the high readout.

But the think tank said inflation in the more heavily-weighted food and non-alcoholic beverages is still way higher and increased to 10.7 percent from 10.2 percent.

GRAPHIC Ed Lustan

A closer look at PSA data showed that acceleration in prices of cereal products, like rice and corn and bakery products hit 5.6 percent, while milk, eggs and dairy products hit 11.3 percent.

The higher food inflation was mainly brought about by the increased year-on-year growth in the price index of vegetables, tubers, plantains, cooking bananas and pulses at 37.8 percent, the PSA said.

Higher annual mark-ups were also observed in the indices of fish and other seafood (6.7 percent) and fruits and nuts (9.8 percent).

Sugar, confectionery and desserts retained their previous rate of 38.8 percent, while oils and fats had a readout of 18.5 percent.

Then in housing, water, electricity, gas and other fuels, actual rentals for housing was at 5 percent, while maintenance, repair and security of dwelling was at 5.2 percent.

Electricity, gas and other fuels had an inflation rate of 15.9 percent then water supply and miscellaneous services relating to dwelling was 6 percent.

Higher increases were also observed in alcoholic beverages and tobacco (10.9 percent), clothing and footwear (4.4 percent), and recreation, sport and culture (4.2 percent).

The PSA said inflation in furnishing, household equipment and routine household maintenance was at 5.2 percent, while it was 3.6 percent and 3.3 percent in education services and health.

Restaurants and accommodation services and information and communication had a readout of 7.6 percent and 0.7 percent, while personal care and miscellaneous services was at 5 percent.

Out of the 13 commodity groups being monitored by the PSA, only transport had a lower readout relative to its rate in the previous month—11.7 percent to 11.2 percent.

Wage hikes needed

As stressed by Ibon Foundation, even with high inflation, the gap between workers’ wages and the needed income for a family of five to live decently continues to widen.

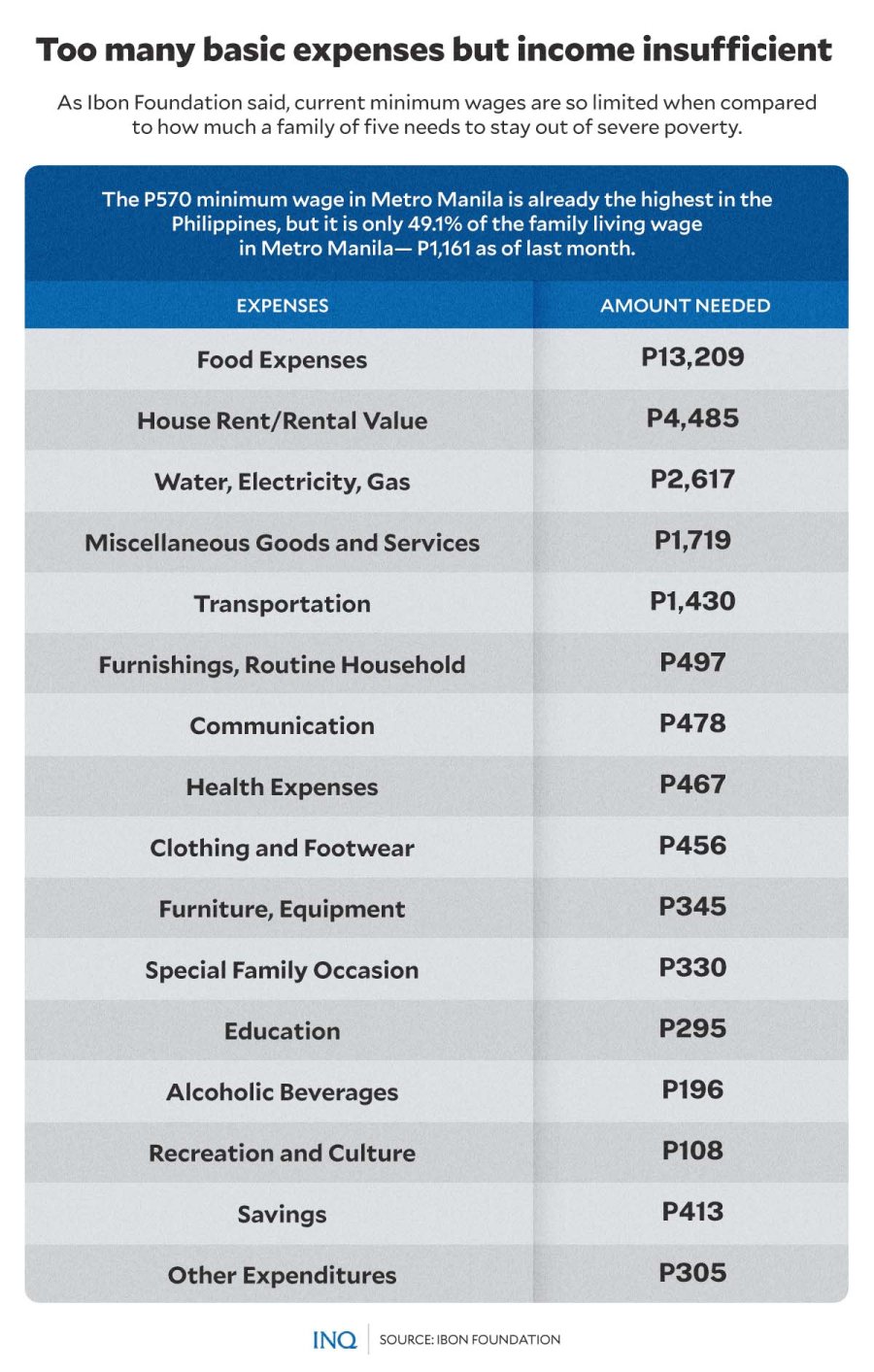

Take as an example the minimum wage in Metro Manila, which is already the highest in the Philippines, but as the think tank said, is not even half of the family living wage in the region.

GRAPHIC Ed Lustan

It said the P570 minimum wage in Metro Manila is only 49.1 percent of the P1,161 family living wage in the region as of January 2023.

Then in the Bangsamoro Autonomous Region in Muslim Mindanao (BARMM), which has the lowest minimum wage, the P341 basic daily pay is only P17.5 percent of the region’s family living wage of P1,944.

“The real value of these minimum wages have continued to fall and are down to P482 for Metro Manila and P285 for BARMM, measured at 2018 prices,” it said.

Based on a survey conducted by the World Bank, “high inflation tends to lower the real minimum wage, while also increasing poverty.”

“If minimum wages increase less than the price of goods consumed by wage earners, a workers’ real income will decline,” it said.

GRAPHIC Ed Lustan

But Ibon Foundation said the government “has been tepid towards giving wage increases, claiming that doing so would be inflationary.”

A closer look at data comparing wage increases and inflation since 1986 disputes this claim, though, it said.

It said out of the 31 wage hikes, 15 wage hikes were followed by slower inflation in the six months after. It was only in the other wage hikes that inflation increased.

“This showed that it is not true that wage hikes would automatically lead to higher inflation,” the think tank said.

“A wage hike would give relief to millions of workers. This need not be inflationary if employers become more willing to give up part of their profits to enable higher wages for their workers,” it said.

Ibon said the government can also help micro, small and medium enterprises give higher wages with a program of wage subsidies and other financing support.

Last year, the Department of Labor and Employment said it is assessing wage rates in the Philippines, stressing that “we will continue to use the existing tripartite wage mechanisms to help address the situation, and we will do so prudently.”

Labor Secretary Bienvenido Laguesma previously explained that the most recent wage orders only came out past June last year and that some Regional Tripartite Wages and Productivity Boards are still expected to approve a second tranche this year.

Poor’s sacrifices

Based on Ibon Foundation’s computations, most of the P1,161 a day or P25,246 a month family living wage in Metro Manila was expected to go to food expenses (P13,209) and house rent (P4,485).

At least P2,617 goes to expenses for water, electricity and gas, while P1,719 and P1,430 are for miscellaneous goods and services and transportation.

This leaves the family P497 for furnishings and routine household expenses, P478 for communication, P467 for health expenses, and P456 for clothing and footwear.

GRAPHIC Ed Lustan

The rest is for furniture and equipment (P345), special family occasion (P330), education (P295), alcoholic beverages (P196), recreation and culture (P108), and savings (P413).

This is ideal, though, if a family of five in Metro Manila really gets the living wage being suggested by Ibon Foundation.

With P570 a day or P12,540 a month minimum wage in the region, just imagine how much is left for health expenses, education and savings.

Based on data from the Bangko Sentral ng Pilipinas, 18.6 million or 70 percent of households do not have savings as of the last quarter of 2022 and were essentially living hand-to-mouth.

Take the case of Danao, who stressed that if they will not tighten their belts and sacrifice some needs, even if essential, nothing will be left of what limited money they have.

“Talagang sa mga pinaka-kailangan na lang sa araw-araw napupunta ang pera namin—sa pagkain tapos sa gasolina ng motor ko kasi ginagamit ko sa pagpunta sa bukid.”

(Most of what we have goes to what we need most for everyday living such as food and gas, too, since I need it for my motorcycle, which I am using to go to work.)

“‘Yung ibang gastusin, saka na namin proproblemahin kapag nagkapera na o kaya kapag kailangang-kailangan na,” he said.

(With regard to the rest of our needs, we will take a look at it once we have enough money or once it becomes really urgent.)

As investment strategy analyst Ross Mayfield told Bloomberg, one easy step to cope with inflation is to focus on what you can control.

However, she stressed that for most people, “it’s not reasonable” to ask them to not consume less since there are really daily necessities.

She said, as stated by Claire Ballentine and Charlie Wells in a Bloomberg article last year, “consumers are most likely to find some wiggle room if they look at their finances as either ‘needs’ or ‘wants’.”

You can control “wants,” such as leisure activities or eating out at restaurants, Mayfield said.

Millions threatened with poverty

As Ibon Foundation said, the high inflation is threatening to drive millions of Filipinos into poverty and hunger, especially with the acceleration in housing, water, electricity and gas.

The think tank said food prices remain the main problem with inflation and underscored the “failure” of the Department of Agriculture, which is led by the President himself.

The biggest weights in the consumer price index were given to food and non-alcoholic beverages (38 percent), housing, water, electricity, gas and other fuels (21 percent), and restaurants and accommodation (9.6 percent).

Brookings Institution, a public policy organization, said for most households all over the world, rising inflation poses a significant challenge.

This, as “higher prices can erode the value of real wages and savings, leaving households poorer.”

“High inflation tends to worsen inequality or poverty because it hits income and savings harder for poorer or middle-income households than for wealthy households.”

“Households that have recently escaped poverty could be pushed back into it by rising inflation,” it said.

As stressed by Ibon Foundation, “amid worsening informality of work, falling family incomes and growing poverty, the government should provide meaningful cash assistance and wage hikes as well as support for rural producers and small businesses.”

It said “the government should be taken to task for giving mere lip service to dealing with inflation since taking office.”

This, as it pointed out that inflation has been accelerating for the last seven months apart from a momentary and only incremental dip in August 2022.”

“It can help millions of Filipino families that can hardly make ends meet” by “expanding social protection for the poorest families, a wage hike, and support to rural producers and small businesses is possible,” Ibon said.